Treasury said Finance Minister Enoch Godongwana will introduce legislation that reverses his decision.

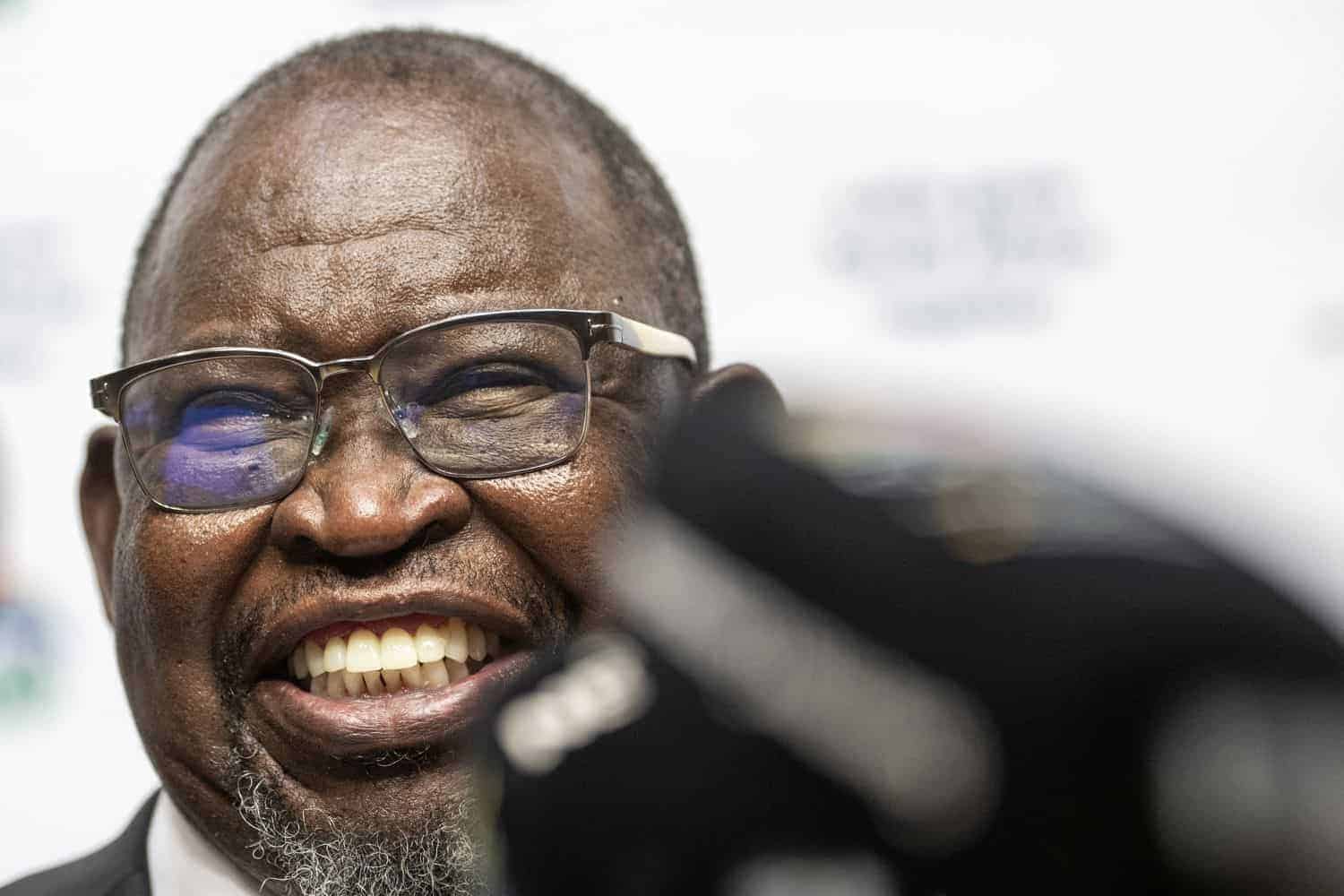

Minister of Finance Enoch Godongwana briefs the media after the budget speech was postponed at Imbizo Media Centre on February 19, 2025 in Cape Town, South Africa. Picture: Burger/Jaco Marais

The proposed VAT increase has been reversed and will remain at 15%, ending a two-month battle and legal challenges over the unpopular tax hike.

The treasury made the announcement shortly after midnight on Thursday.

The VAT rate was scheduled to rise to 15.5% on 1 May, but growing political and public pressure placed Finance Minister Enoch Godongwana under strain to abandon the proposed increase.

VAT reversed

Treasury said Godongwana will introduce legislation that reverses his decision to implement an initial 0.5 percentage point hike on 1 May, followed by a second hike by the same margin on April 1 next year.

“The Minister of Finance will shortly introduce the Rates and Monetary Amounts and the Amendment of Revenue Laws Bill (Rates Bill), which proposes to maintain the Value-Added Tax (VAT) rate at 15 per cent from 1 May 2025, instead of the proposed increase to VAT announced in the Budget in March,” the Treasury said.

ALSO READ: EFF calls for ‘apartheid tax’ counter instead of VAT hike [VIDEO]

“The decision to forgo the increase follows extensive consultations with political parties, and careful consideration of the recommendations of the parliamentary committees. By not increasing VAT, estimated revenue will fall short by around R75 billion over the medium term.”

Parliament

Treasury said Godongwana has written to the Speaker of the National Assembly, Thoko Didiza, to indicate that he is withdrawing the Appropriation Bill and the Division of Revenue Bill and proposing expenditure adjustments to cover this revenue shortfall.

“Parliament will be requested to adjust expenditure in a manner that ensures that the loss of revenue does not harm South Africa’s fiscal sustainability.

“The decision not to increase VAT means that the measures to cushion lower income households against the potential negative impact of the rate increase now need to be withdrawn and other expenditure decisions revisited,” the Treasury said.

Out of court settlement

The announcement came shortly after the DA said their lawyers had been approached with a proposal for an out-of-court settlement in its challenge against the increase.

“The DA is awaiting a formal written settlement offer before responding to the Minister’s request. We will update the public of developments in due course,” the DA said.

“We can also confirm that a DA delegation is due to meet a high-level ANC delegation tomorrow, at which these discussions will be taken further.”

The DA approached the courts to have the 0.5 percentage point VAT increase announced by Godongwana in his March Budget Speech set aside and to interdict its implementation on 1 May.

The EFF also joined the case as an “intervening party”, opposing the VAT increase and the finance committee decisions to adopt the fiscal framework.

Fiscal framework

While Godongwana did not oppose the adoption of the fiscal framework, he challenged both the interdict and the action against the VAT Act.

In his answering affidavit, the minister asserted that the VAT increase decision “cannot be interdicted at this stage” and argued that the relief being sought is “moot”.

VAT motivation

Treasury said the initial proposal for a VAT increase was motivated by the urgent need to restore and replenish the funding of “critical frontline services that had suffered reductions necessitated by the country’s constrained fiscal position.”

“There are many suggestions, however, some of them would create greater negative consequences for growth and employment and some of them, while worthwhile, would not provide an immediate avenue for further revenue in the short term to replace a VAT increase.”

Treasury said it will “consider” other proposals as potential amendments in upcoming budgets.

ALSO READ: ‘Serious option’ on the table as Treasury, Sars seek ways to reverse VAT hike amid legal battle

Download our app