Load shedding eased to stage 4, Eskom announces

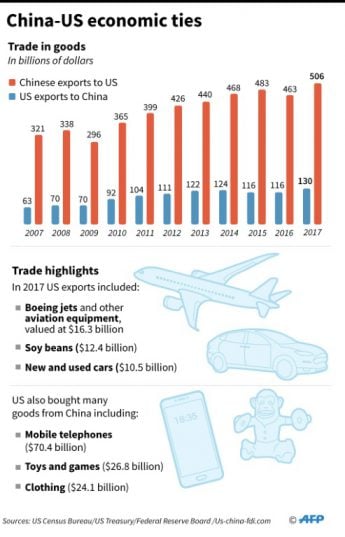

Beijing unveiled plans for painful import duties targeting politically-sensitive US exports, including soybeans, aircraft and autos, to retaliate against looming US tariffs on more than 1,000 Chinese goods.

Wall Street opened sharply lower but investors apparently later decided their fears might be overblown and stocks closed higher.

President Donald Trump’s newly-installed economic advisor Larry Kudlow said the stock market anxiety was understandable but “at the end of the rainbow, there’s a pot of gold.”

Kudlow is well known to financial markets after many years as an analyst on CNBC.

Trump, meanwhile, unleashed a tweet storm, declaring the United States is “not in a trade war with China” and implying he was simply fixing the mistakes of previous administrations.

Commerce Secretary Wilbur Ross dismissed fears the trade confrontation could endanger the world’s largest economies.

Ross, in an interview with CNBC, downplayed Beijing’s retaliation, saying the $50 billion in US exports targeted for sanctions only amounted to about 0.3 percent of US GDP.

“So it’s hardly a life-threatening activity,” he said.

China’s ambassador to the United States, Cui Tiankai, was at the State Department for talks with acting secretary of state John Sullivan.

As he left, he expressed the hope full-blown trade war could yet be avoided.

“Of course, negotiation would still be our preference, but it takes two to tango. We will see what they will do,” Tiankai told reporters.

State Department spokeswoman Heather Nauert said: “The acting secretary reiterated the need to restore fairness and balance to our economic ties.”

US President Donald Trump signs trade sanctions against China prompting an escalation in tensions that many fear could spillover into an all out trade war

But some US markets already have responded to the trade spat with higher prices and tighter supplies even though the largest of the retaliatory duties have yet to take effect.

Steel and aluminum suppliers began raising prices within 24 hours of Trump’s announcement last month of his intention to impose import tariffs, according to the Institute for Supply Management.

Industry groups renewed calls for the White House to change tack.

The powerful US Chamber of Commerce, a stalwart supporter of Republican lawmakers, said tariffs were “not the way” to achieve fairer trade with China.

And aviation giant Boeing, which could see some of its smaller planes hit by China’s tariffs as well as higher metals costs, said the spat could “do harm to the global aerospace industry.”

The company said it “will continue to engage both governments” as the sides note that “productive talks are ongoing.”

– Will Trump blink first? –

China is the largest market for US soy and the threat of tariffs on exports of the commodity has the potential to whip up trade anxieties in stalwart Republican areas.

The American Soybean Association called on the Trump administration “to reconsider the tariffs that led to this retaliation.”

Scott Miller, a trade policy expert at the Center for Strategic and International Studies, told AFP the tariffs proposed so far were unlikely to dent overall economic growth.

China is the largest market for US soy, and soy-farming states are key sources of Republican support, adding a political dimension to the trade dispute

But that “does not mean there isn’t going to be a political backlash,” he said.

“I think China is perfectly happy to play a game of chicken with the United States on this because they believe the US will blink first.”

But a US trade official told reporters the China’s retaliation is “simply an effort to intimidate us or to get us to back down so that they can continue doing all the bad things” including taking intellectual property from American companies.

Other than steel and aluminum, the tariffs are only threat at this point: the US will have a 30-day comment period before determining the final list of Chinese goods on the hit list, and China also is holding off pending talks.

Should the tariffs go into effect, however, they would make for one of the largest trade wars ever involving the United States, said Gary Clyde Hufbauer, a trade expert at the Peterson Institute for International Economics.

The amount $50 billion “in each direction is far larger than previous trade spats that we’ve had,” he told AFP.

But Hufbauer said as November’s mid-term elections approach, the political ramifications of the current trade policy could be greater than the economic ones for Trump.

“He’s hurting his base, he’s really annoyed a lot of Republicans in the senate and the house,” said Hufbauer.

“The way he’s going now, he’s got to compromise out to have a chance of keeping the Congress Republican in November.”

Download our app