For the first time since December 2009, we’ve witnessed value stocks pulling ahead of growth stocks over a one-year period: Dr Andrew Dittberner.

Over the long term, value styled investing outperforms growth styled investing. However, for the last seven years, both globally and in South Africa, value investing has underperformed.

Dr Andrew Dittberner, CIO at Cannon Asset Managers believes this recent trend has reversed. “For the first time since December 2009, we have witnessed value stocks pulling ahead of growth stocks when measured over a one-year period,” says Dittberner.

This can be seen in Graph 1 which shows the one-year rolling returns of the two different styles relative to the market.

Graph 1: Rolling 1-year returns from JSE Value Index, JSE Growth Index and JSE All Share Index

“It is clear to us that the cycle of growth vs value has turned, but what does this mean for investors? Style cycles tend to work in long trends,” says Dittberner. “Asset Managers who were successful over the last seven years would no doubt have had a growth bias in their portfolios. But this year we have seen a resurgence of value styled funds and investors who own growth biased unit trusts should consider allocating more capital to value.”

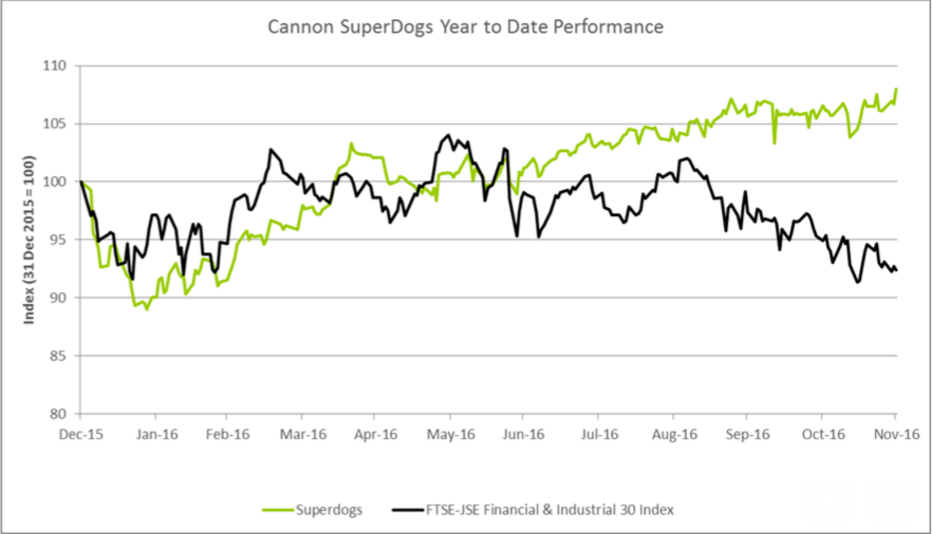

Those who have invested in value funds will have experienced outperformance over the past year. An example is the Cannon SuperDogs fund which is up 8% year to date, relative to its benchmark, the FTSE-JSE Financial & Industrial 30 Index which is down 7.6%. What is more interesting is that the fund owns no resource shares, which have also done very well this year and were also showing strong value at the start of the year.

Graph 2: Indexed SuperDogs vs benchmark performance, 1 January 2016 = 100

But perhaps the most important question is “Where to from here?”

Given the poor performance of value over the last seven years, the number of pure value managers has once again dwindled. History seems to be repeating itself: towards the end of the 1990s, there were only two value managers left in South Africa after the growth boom of the mid 90s, yet there were plenty of growth managers.

“We believe there are now only four deep value managers left in South Africa as investors abandoned the style and value firms closed down or style drifted towards growth,” notes Dittberner.

These style cycles have typically lasted anywhere up to five years and we believe that this represents the start of an extended period of value outperforming growth. Investors who wish to capitalise on this trend would do best by seeking out a pure value manager.

-Brought to you by Moneyweb

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.