When Trump starts implementing all his proposed economic policies, it may initially negatively affect US and global economic growth.

While many US citizens who voted for Donald Trump say they voted for better economic conditions, an economist warns that his policies could cause an initial global and US economic downturn.

Maarten Ackerman, chief economist at Citadel, expects continued sticky inflation, a strengthening dollar and strained global trade relations as a result of Trump’s proposed ‘America First’ protectionist policies.

“While his proposed ‘America First’ policies are about economic growth, the irony is that protectionism will be creating its own set of economic headwinds.”

He warns that inflation, which is a global problem, will not disappear overnight.

“With the Senate and House secured by the Republicans, the potential for a ‘red sweep’ raises expectations that the party could more effectively pursue its global macroeconomic and domestic economic policies aimed at fostering economic growth and reducing inflation.

“However, these policies may initially have the opposite effect of what he promised, as the Republicans’ hardline immigration policies will affect the availability of affordable labour and their trade policies will not make inflation disappear overnight.”

ALSO READ: Trump victory: Trouble for the rand and Brics allies, joy for crypto

Trump wants to produce in America

Ackerman points out that Trump wants to produce in America. “His protectionism will lead to a stronger dollar, which is exactly what he wants and will also further slow down global trade. In addition, his proposed tariffs on imports will further slow trade and hike inflation.”

Having called ‘tariff’ his “favourite word in the dictionary”, Trump promised 200% trade tariffs on Mexican cars and 60% tariffs on certain Chinese products.

George Herman, chief investment officer at Citadel, says Republican policies could cause “the largest ever impact on the fiscal deficit”.

“The US deficit is almost twice the size it was in 2016 and will probably get to Covid levels, which was a very unusual time with a lot of spend from government to get the economy going. The US will keep on borrowing, but the cost of borrowing will have to increase.

“Looking at government debt in relation to gross domestic product (GDP), the already enormous US debt-to-GDP ratio of 125% is expected to increase to 140% of GDP by 2035.”

ALSO READ: What another Trump presidency means for Africa: bullying to pick sides

Trump’s plan to cut corporate and wealth taxes

Ackerman says an environment of cutting corporate and wealth taxes can be positive for equity markets in the short term. “However, where will you get the revenue from to actually finance a deficit like this?”

Herman also points out that the market reactions last week were severe. “The dollar strengthened materially and several asset classes were affected right away. As expected, ‘Trump Trade’ was priced into the market, but the ‘red sweep’ was not priced in.

“The gold price fell a good 5% on the back of his promise to ‘end the Ukraine conflict in 24 hours’. The copper price also took a 5% smack, because Trump has made it clear he is not a fan of renewables and has promised to ‘drill, drill, drill’.”

However, he points out that Bitcoin on the other hand, which is firmly backed by Trump and his friend Elon Musk, reached a new all-time high of $75 000.

“Trump will cut corporate taxes, which is good – in the short-term – for the equity markets. We saw the S&P500 increase by 2.5%, the Nasdaq by 2.5% and the Russell 2000, which contains smaller cap stocks, by 6% and the Dow Jones by 3-3.5%.

“However, these movements were a US phenomenon and speak to US exceptionalism and are not reflected in other global equity markets.”

ALSO READ: Trump as president: What it will mean for SA

US treasury yields

Turning to US treasury yields, Herman explains that it sold off by 20 basis points last Wednesday on top of 60 points in the buildup to Trump’s re-election.

“This is an enormous move, considering that it usually moves by only two to three basis points on any given day. Now consider that in 2022, when US yields sold off as aggressively, it throttled the equity market and equities took a step back. We have not seen that yet.

“We have seen the opposite now, where equities rally while bond yields are increasing. Therefore, this higher cost of debt will filter through into the economy.”

Herman warns that while US equity is much stronger in the short-term on the back of the promise of lower corporate taxes and higher US yields, there is a fear in the market of increased overall debt levels for the US.

ALSO READ: Will markets catch a cold from US election fever?

Impact of Trump’s policies on SA

What is the impact of Trump’s policies on South Africa and other emerging markets? Herman says the knock-on effect of a stronger dollar is very important for South Africa, as it places our commodities under pressure and is negative for emerging markets.

Another emerging market that will be hard-hit by Trump’s adversarial stance is Mexico. “Mexico is a sensitive issue for America, specifically due to illegal immigrants. Trump will impose mass deportations and high trade tariffs.”

While the protracted trade conflicts already made China more self-sufficient, which meant that Trump’s re-election was “no real body blow to China”, China will have to focus on finding more alternative trade partners, Ackerman says.

“Firstly, China must move to a policy of self-reliance on energy or trade. That is why they try to stimulate consumption expenditure in the Chinese economy. If they are going to replace American trade, it will most likely be with other emerging countries, specifically in Africa. Therefore, it is a totally new world post-Covid regarding how these alliances and trade partners get put together.”

ALSO READ: US election: short-term volatility in global markets a given – economist

Impact of trade tensions on global supply chains

And the impact of trade tensions on global supply chains? Herman says in this new world of re-globalisation, or de-globalisation, of new trading partners, we abandoned the most efficient, cheapest logistical supply chains in products, for ‘friend-sharing’, trading with friends or alliances, which implies higher prices and more inflation.

He believes Brics may provide some new opportunities for South Africa in the new world order. “Brics started showing muscle against the West over the past five years. The G7 and the Brics members are pretty much head-locked in some policy decisions and Africa is right in the middle.

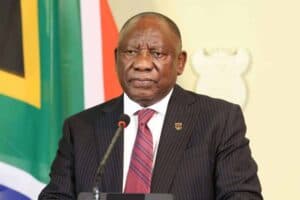

“It will create some opportunities for Africa and the emerging markets. President Cyril Ramaphosa was also quick to emphasise that South Africa takes over the G20 presidency in 2025 and in 2026 it is the US’s turn.”

He says it is clear that the president wants to build relations during this period, while the minister of international relations and cooperation, Ronald Lamola, has been quite outspoken about anti-West, anti-American views.

Herman warns this does not bode well for South Africa’s place in the AGOA trade agreement under a Trump administration.

“The world is entering an environment with below average growth and sticky inflation. The trade conflict is now global. Geopolitical challenges may intensify. We are preparing for a slow growth environment. Interest rates can decline further, but we will probably not go to pre-pandemic levels.”

It is therefore more important than ever to have well-diversified, long-term and weather-proof investment strategies. “Politicians come and go. There are shorter term opportunities and we will definitely include that in our portfolios, but the thinking must always be long-term and adjusted for risk.”