The decision is the result of worsening economic recovery in both the developing and developed markets, and spiked global inflation.

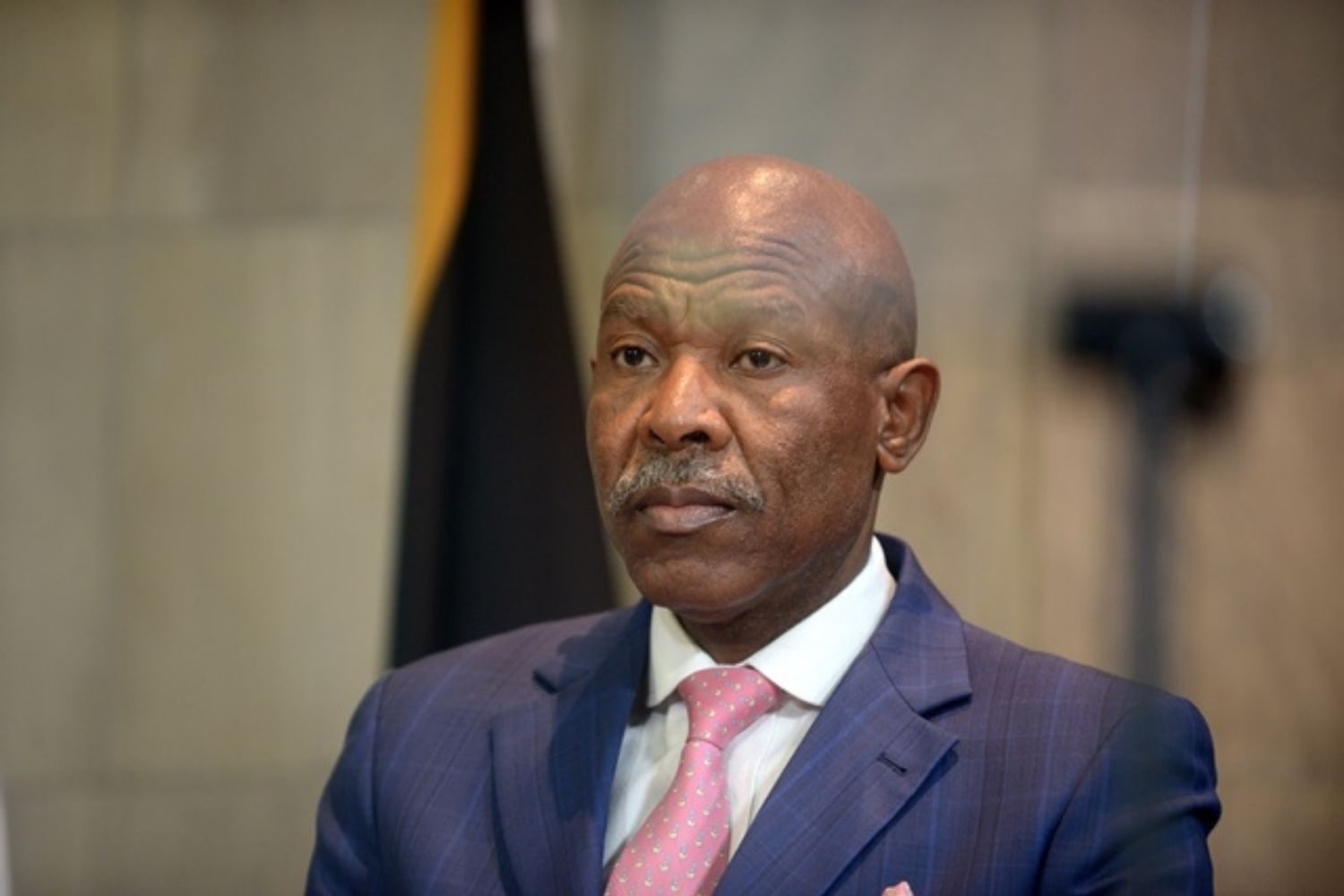

Reserve Bank governor Lesetja Kganyago has announced a repo rate increase of 50 basis points (bps), after the bank’s May Monetary Policy Committee (MPC) meeting on Thursday.

The governor cited spiked global inflation for the decision, taking the bank’s key rate to 4.75% and the prime lending rate of commercial banks to 8.25%.

The repo rate was previously at 4.25%, while prime lending was 7.75%.

“Investor appetite for riskier assets is weaker, and asset value in major markets has declined,” said Kganyago.

“Economies that didn’t take advantage of better global conditions or reduce large macroeconomic imbalances remain vulnerable to currency depreciation,” he said.

The Reserve Bank governor said that last year, South Africa’s economy was recovering from the pandemic, expanding by 4.9%.

The economy was expected to grow by 2% this year, but that projection has been revised down to 1.7% at the time of the March meeting.

This is due to a combination of short term factors like KZN floods and continued electricity supply constraints.

Kganyago said worsening economic recovery in both the developing and developed markets remained slow and vulnerable.

NOW READ: No runaway inflation just yet, but repo rate likely to increase

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.