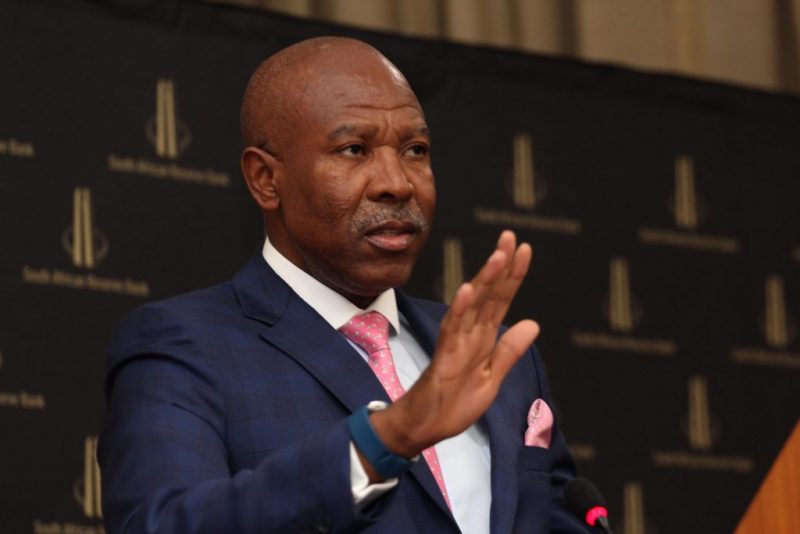

Lesetja Kganyago said the Monetary Policy Committee decided this time to fight inflation more aggressively.

South Africa’s central bank has raised interest rates on Thursday even though inflation remains contained within target while economic growth is still worryingly anaemic.

The increase of 25 basis points takes the rate to 6.75%. The prime lending rate is now 10.25%.

BREAKING: @SAReserveBank has decided to raise Interest rates by 25 basis points to 6.75% (repo rate) & 10.25% (prime lending rate) #SABCNews #MPC

— Arabile Gumede (@ArabileG) November 22, 2018

The South African Reserve Bank’s (SARB’s) monetary policy committee (MPC) held its last of six annual meetings to ponder interest rates and its chairman, Governor Lesetja Kganyago, announced its decision at a news conference later today.

The central bank cut the benchmark repurchase rate at which it lends to commercial banks by 25 basis points at its second meeting of the year in March, but kept it steady at 6.5% since. The decision on keeping rates unchanged has been a close vote, with only one vote normally deciding the matter either way.

Annual consumer inflation has risen steadily from 3.8% year-on-year in March to 5.1% in October, according to data from Statistics South Africa, but is still inside the Reserve Bank’s 3% to 6% target band.

The economy continues to struggle, dipping into a technical recession with a consecutive contraction in the second quarter. The National Treasury has cut the overall growth forecast for 2018 to 0.7% from the 1.5% predicted in February.

The rand currency has lost ground against the US dollar – adding to inflation pressure – since a rally earlier in the year partly spurred by the appointment of largely respected former businessman Cyril Ramaphosa as South Africa’s president to replace the scandal-ridden Jacob Zuma.

For more news your way, download The Citizen’s app for iOS and Android.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.