It’s been a tough year for global communities - more so for South Africans with persistant power cuts that has crippled economic growth.

South Africans have, for 2022, seen three significant repo rate hikes: in May, July and September.

It’s been raised by a cumulative 200 basis points, bringing the nominal report rate to 6.25%, and it could likely be raised even higher in the face of volatile global and domestic conditions.

Monetary Policy Committee

In May, the Monetary Policy Committee (MPC) unanimously agreed to raise the repo rate by 50 basis points to 4.75%.

In July, they raised it by 75 basis points to 5.50%, with three members having expressed a preference for the announced increase, one member preferring a 100 basis points increase, and another member preferring a 50 basis points increase.

By September, they raised it by another 75 basis points to 6.25%. Three members had expressed a preference for the announced rate increase, while two members preferred a 100 basis points increase.

ALSO READ: Reserve Bank raises repo rate once again

On Tuesday, the South African Reserve Bank released its Monetary Policy Review, which it covers domestic and international developments that affect the monetary policy stance over the past year, and in months to come.

Devasting floods in April

The May 2022 meeting of the Monetary Policy Committee (MPC) was held against the backdrop of the devastating floods in April.

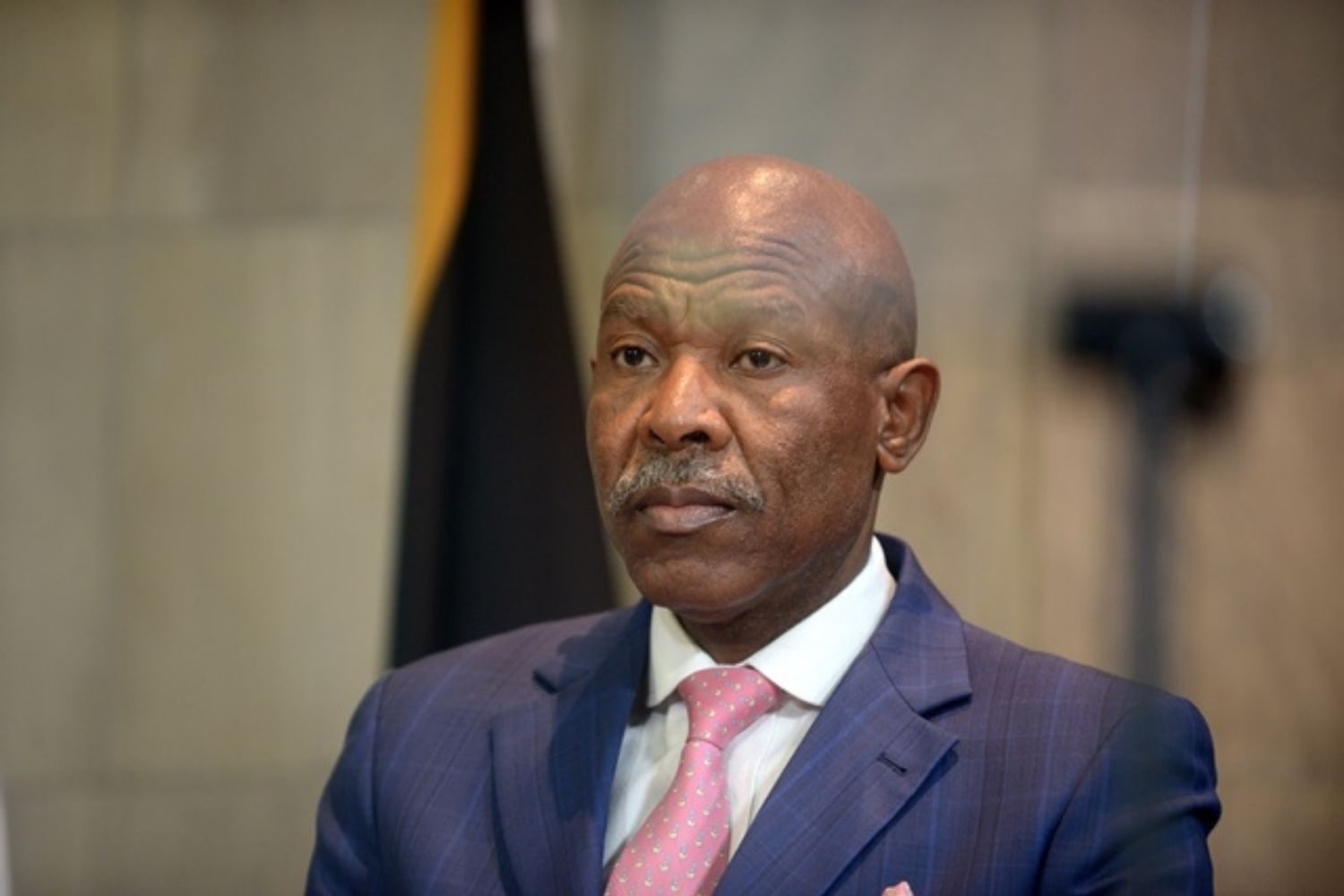

South African Reserve Banks governor Lesetja Kganyago said while the South African economy was expected to grow by 2.0% in 2022, this was revised down to 1.7% due to the flooding in KwaZulu Natal (along with other factors), which saw considerable damage to infrastructure and the dire need for budgets for relief interventions.

A significant amount of commercial buildings, as well as housing and road infrastructure, were badly damaged, resulting in major losses for companies as it halted production lines across the province.

NOW READ: Biggest interest rate hike since 2002 to drain South Africans’ pockets

As a result, GDP growth for South Africa in the second quarter was revised lower to 0.0%, from 0.6% in March.

Russian invasion of Ukraine

Russia’s invasion of Ukraine has weighed heavily on global economic growth and also contributed to higher inflation.

The war impaired the production and trade of a wide range of energy, food and other commodities.

Higher oil, commodity and food prices, additional constraints to trade and finance and rising debt costs dramatically worsened economic conditions for both emerging and developing countries.

ALSO READ: In pictures: The war in Ukraine continues

By July, economic data releases preceding the July meeting of the MPC painted a mixed picture of the outlook for growth and inflation. Economic activity had recovered to pre-pandemic levels by the first quarter of 2022, but the economy was projected to contract sharply (by 1.1%) in the second quarter.

Loadshedding

At the September meeting of the MPC, the headline inflation forecast was unchanged at 6.5% in 2022 but revised lower to 5.3% in 2023 (5.7% in July) and 4.6% in 2024 (4.7%).

Domestic growth was revised slightly lower for 2022 due to persistent load-shedding, amongst other factors.

According to the data collected by the EskomSePush app, there were two load shedding peaks in 2022 — the worst year of load shedding for South Africa to date.

NOW READ: Load shedding: ‘I am gatvol and so are 60 million other South Africans’.

The first peak occurred at the end of June and continued in the first half of July.

The second load shedding peak started early in September and is still ongoing.

The Reserve Bank has said that this has severely halted economic growth in the country and will continue to do so.

The central bank expects the continuous power cuts to decline economic growth by at least one percentage point.

Inflation

Kganyago explained that higher-than-expected inflation had pushed major central banks to accelerate the normalisation of policy rates, tightening global financial conditions and raising the risk profiles of economies needing foreign capital.

The risks to inflation identified over the past year were realised, pushing up South Africa’s headline inflation rate and inflation expectations.

ALSO READ: South Africa’s inflation dips in August after drop in fuel price

In the second quarter of this year, headline inflation breached the upper limit of the target range and is expected to remain above it until the second quarter of 2023.

And that’s how we ended up here

The growth outlook for the world economy has been downgraded further since the previous MPR as high and persistent inflation coupled with tightening financial conditions and geopolitical tensions weigh on global supply and demand.

After a slow start to monetary tightening and amid intensifying core inflationary pressures, central banks have raised policy rates more aggressively to prevent a de-anchoring of inflation expectations. They are expected to continue.

Higher inflation and interest rates increase the risks for many economies – developing, emerging and advanced – with higher debt levels post-Covid19.

Looking ahead

It’s been a tough year for global communities and South Africans alike, and it seems like economics will not be making its way out of the woods just yet.

While it seems as though the SA economy has officially recovered to pre-Covid levels, the issues of damaged and ailing infrastructure, the continuation of the conflict in Ukraine, persistent power cuts halting production lines and high global inflation continue to threaten SA’s economic growth.

As such, a ‘global’ monetary policy tightening cycle is underway. Central banks are thereby reducing monetary accommodation. SARB said it expects headline inflation to moderate to 6.5% this year.

Global market expectations of future policy rate hikes have also been revised higher in recent quarters, consistent with central banks’ communicated intent to bring inflation lower sooner.