For a nation used to erratic services, a non-stop offering seems unlikely. But China's biggest ICT company has a plan for Africa.

ICT giant, Huawei’s sub-Saharan Africa Region’s president, Leo Chen, has put the concept of non-stop banking on the African table. What exactly is non-stop banking?

To South Africans who are still suffering from load shedding PTSD, non-stop anything seems like a far-fetched ideal at the moment.

To understand non-stop banking, we first have to understand the different ‘revolutions’ through which banking has come – not unlike that of the industrial one.

‘Non-stop banking’

According to a white paper by TSYS[1] – a financial tech company based in the US, ‘Bank 1.0’ referred to banking that is done through and in a financial institution with transactions primarily handled through traditional banking channels.

It is centred around the branch as the primary access point. (Fun but irrelevant fact: this sort of banking started with the Medici family in the 12th century.)

Bank 2.0 and 3.0

Bank 2.0 explores more the idea and emergence of self-service banking and can be traced back to the initial efforts to make banking services available beyond regular working hours.

Think of the deployment of ATMs for example.

However, it wasn’t until the commercial internet gained momentum in 1995, that this trend accelerated significantly.

As we entered the age of the smartphone in 2007, so too we entered the era of Bank 3.0.

This concept of banking looked at transactions being available to customers when and where they require it, and was redefined with the arrival of smartphones.

This approach to banking is channel-agnostic, meaning that customers can access services from any channel or device they prefer.

ALSO READ: Power-M: Finally an all-in-one load shedding solution

Now there’s Bank 4.0.

This refers to the seamless and integrated banking experience that is delivered in real-time through technology.

This type of banking is characterised by context-specific interactions that are effortless and convenient, with a layer of intelligent advice based on artificial intelligence.

It is entirely digital and available through multiple channels, with no need for a physical bank branch, an actual human banker or a distribution network.

The focus is on providing frictionless engagement to customers at all times, regardless of their location or device.

This is non-stop banking.

ALSO READ: REVIEW: Huawei Mate50 Pro

Part of the experience of real-time banking through technology which is no longer defined by brick and mortar, is 24/7 service 365 days a year.

This means immediate payments and applications (amongst other things) on even the most auspicious of public holidays, without waiting for days and weeks to be approved or cleared.

But how can non-stop banking be achieved without, you know… breaking the bank?

Road map for Africa

This is where Huawei has come in to provide the roadmap for Africa to enter the Bank 4.0 era.

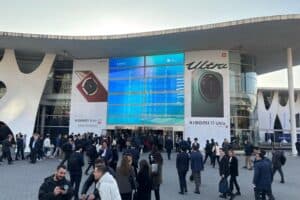

At this year’s Intelligent Finance Summit for Africa 2023, Chen advised that through hand-in-hand collaboration between the ICT and banking industries, introducing automation, algorithms and machine learning to a number of areas within the bank’s operations (as well as teaching all staff not just tech staff to use technology) will usher the African banking customer into this new era.

But how plausible is non-stop banking in the face of an energy crisis?

South Africans remain sceptical though as the country grapples under the strain of rolling blackouts with businesses experiencing more downtime than has been bearable.

But optimists like Chen believe that Bank 4.0 might just be exactly what the country needs to propel its battling economy, giving it the wings it needs right now.

ALSO READ: AfricaCom 2022: Huawei addresses digital transformation’s big business opportunity

At this year’s summit, Huawei was not entirely tone-deaf to the energy plight of South African entrepreneurs and came to the table with viable solutions.

Inside the exhibition area of the summit, Huawei introduced a number of its innovative digital energy solutions that could help to provide an uninterrupted and green power supply for the banking sector.

Many of which, like the Power-M hybrid energy solution, are a lot more innovative, aesthetically new-age and less expensive than the traditional set-ups of solar and generators.

Rest of Africa

Currently, ICT companies like Huawei are guiding more than 2 500 financial customers in over 60 countries and regions, including 50 of the world’s top 100 banks into the new era of banking.

Many of these are already in Africa.

Jason Cao, CEO of Huawei Global Digital Finance, explained: “Huawei is dedicated to helping its African financial customers address challenges and accelerate changes across six fields: shifting from transaction to digital engagement, cloud-native and agile businesses, data democratisation, secure and reliable infrastructure, hybrid multi-cloud and Lego-style modular services, and automated and predictable operation.”

It already has formed partnerships with the likes of EcoBank and NCBA.

Group director for Digital Business at the NCBA Group PLC, Eric Njagi, explained that currently, the bank aims to move money at the speed of trust.

That trust is entirely dependent on the capabilities of technology that they employ.

Stay relevant or die like dial-up?

Author of the book, Bank 4.0, Brett King, expressed that South African banks may have no choice but to board the futuristic banking bandwagon.

“With the average customer spending more than 5 hours a day on their mobile phone, banks can no longer just exist as isolated financial institutions. They need to be seen as a digital-first institution to remain relevant,” he said.

Source:

[1] White paper: Bank 1.0 and Bank 2.0 Success Entails Learning from Each Other’s Best Practices; John Goodale; 2013.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.