When will its long-mooted turnaround kick into gear?

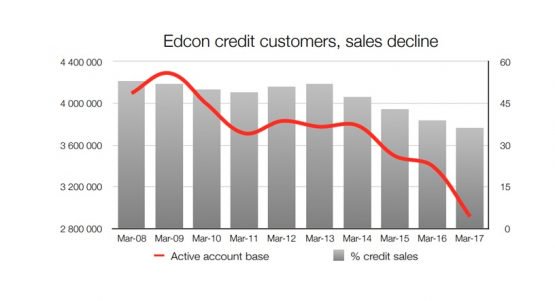

Edcon, South Africa’s largest clothing retailer, has lost 485 000 credit customers in the past year. The group’s full-year 2017 annual report reveals that, as at March 25, it had 2.915 million accounts versus 3.4 million a year ago (and 3.5 million in FY2015).

This number has been in steady decline since its 2009 peak of 4.29 million, with declines accelerating since the sale of its book to Absa (Barclays Africa) in 2012. Since that transaction, Edcon has lost close to 1 million (net) credit customers. Put another way, it has lost a quarter of its (previously core) credit account base.

Just less than a year ago, I argued that Edcon had a third “burning platform” to deal with, aside from the two articulated by its CEO Bernie Brookes: its debit pile and its appeal to customers (see: Edgars has one enormous problem to solve). It had to solve the problem of supplying credit to customers.

Source: Edcon annual reports

Barclays Africa/Absa has tightened the supply of store credit substantially as it scored customers against stricter lending criteria (obvious, in hindsight). Edcon itself states that “credit sales have remained under pressure as a result of tighter lending criteria applied by Absa since November 2012”. The group was in negotiations with African Bank Investments to be a so-called “second-look” credit provider before the lender collapsed into curatorship in August 2014. Edcon had few other options but to start providing credit to customers (again) itself, an effort that was “tested” in 2015. By end-March 2016, its second-look book had grown to R164 million.

However, reading between the lines, Absa’s appetite for extending store credit had tightened even further. Edcon said in May that, “in general”, Absa “has made lower limits available to all new customers”.

Late last year, Edcon renegotiated its arrangement with Absa (for which Edcon incurred R28 million in costs) where “Absa accepts and grants approximately 20% of new accounts with the balance of credit accounts being funded by the group”. That Absa was unwilling to accept eight out of every 10 new credit account applications speaks volumes.

In effect, Edcon will lend to “medium- to high-risk customers” while “Absa will continue to lend to the low-risk customers”. Edcon notes that “Absa has agreed to almost double the limits it makes available to these low-risk customers”.

This new agreement became effective in November, meaning that Edcon traded for five months of its 2017 financial year under the new terms. Its in-house receivables book more than doubled to R418 million as at March 25. But Edcon cautions that its “new arrangement with Absa will take a period of time to drive new credit customers and the number of credit accounts back to acceptable levels”.

This has all happened against the backdrop of the National Credit Regulator’s new affordability regulations implemented in September 2015. These are affecting the entire sector, especially when it comes to increasing customers’ credit limits.

The worry for Edcon is that the rate of decline of its credit sales is increasing.

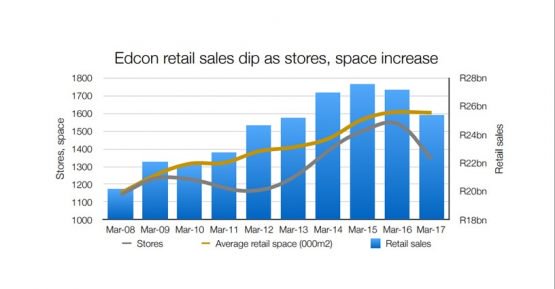

Source: Edcon annual reports

Just more than a third (36%) of group retail sales are now on credit from more than half as recently as four years ago. This is an obvious drag on performance, with retail sales in decline for the past two years.

It did, however, manage to book R1.089 billion in revenue from credit and financial services in the 2017 financial year. This comprised R391 million in administration fees from its insurance business (joint venture with Hollard), R339 million in (credit) administration fees, R184 million in share of profits from said insurance business, and R175 million in finance charges on its in-house credit book. These figures exclude all ‘club’-related income.

Edcon had net trade receivables of R964 million, roughly half of which is its in-house South African book –with the remainder relating to Zimbabwe (R294 million) and Lesotho, Botswana, Swaziland and Namibia (R252 million). The impairment provided for totals R149 million, an increase of R10 million from 2016 (which means its gross accounts receivable totals R1.113 billion).

The group does not provide a segmental breakdown for the impairments, or for its trade receivables past due but not yet impaired. These are small amounts, but the rate of increases are significant.

Source: Edcon annual reports

Shareholders – its former creditors/bondholders – will no doubt be looking for evidence of a turnaround, however nascent, in results for the first quarter of its 2018 financial year (April to June). While these are slightly complicated by the timing of Easter, the increasing rate of decline in credit sales over recent years is (obviously) unsustainable.

In May it told shareholders that, in April, “credit sales were higher than cash sales … for [the] first time since 2010”. It also saw a growth in Ebitda in the month. Has the group found a bottom? It may elect to keep the champagne on ice for a little while longer.

Note: The number of stores figure was impacted by the disposal of 202 Legit stores during FY2017.

Hilton Tarrant works at immedia. He can still be contacted at [email protected]

Brought to you by Moneyweb

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.