The growth in higher-income clients is a ‘highlight’ in the lender’s results, an analyst says.

CEO Gerrie Fourie says Capitec will launch a secured home loan product through a special purpose vehicle with SA Home Loans. Picture: Moneyweb

JSE-listed Capitec is shaking off its image as a lender for lower-income depositors with a 26.5% jump in clients earning R50 000 per month and higher in the past financial year.

Group CEO Gerrie Fourie announced the results for the year ended 28 February 2025 on Wednesday at Capitec’s head office in Stellenbosch – his last results presentation before his retirement in July this year.

Founded in 2001, the lender initially focused on providing affordable and accessible banking services for low-income South Africans. Capitec has since diversified its product offering to insurance, business banking, and value-added services such as cellphone airtime and vouchers for streaming services.

The bank has expanded its client base to over 24 million, with Fourie anticipating it will reach 25 million in the current financial year.

Capitec’s new sales to clients who earn more than R50 000 per month totalled R10.2 million in the past financial year. “The trick is to take those clients and, when they’re 50 and 60 years old, make sure they’re still banking with us,” Fourie noted.

Craig Metherell, equity analyst at Denker Capital, told Moneyweb that Capitec’s growth among high-income earners is one of the “most striking things” in the results.

“I thought that was a real highlight. The wallet that a high-income earner brings to the bank – and the type of products Capitec could cross-sell to them – speak to the kind of ecosystem Capitec wants to create. I expect some of these clients will also open bank accounts for their children who may not yet transact, but they have the potential to grow older with Capitec.

“There’s a very exciting 20 to 30 years coming up for them, because you can lock in these young clients from when they are teenagers and build a relationship with them.”

ALSO READ: Standard Bank and Capitec shake up leadership; Absa spends R165m on 11 people

Expanded home loan offering

Fourie also announced on Wednesday that Capitec will launch a secured home loan product in the middle of the year through a special purpose vehicle (SPV) with SA Home Loans, funded with R5 billion.

In an interview with Moneyweb following the results announcement, he explained that Capitec and SA Home Loans will combine their respective credit models to scale the mortgage offering.

Although Capitec launched its partnership with SA Home Loans in November 2020, the mortgages have been solely on the SA Home Loans balance sheet. Fourie said SA Home Loans lacks sufficient funding to expand the credit book, but with Capitec’s financial support, this growth will be possible.

ALSO READ: Capitec hit by R56m Sarb financial penalty

Insurance market share

Capitec’s strategic initiatives for the financial year ahead include taking its insurance offering and business banking “to the next level”, Fourie mentioned at the presentation.

Capitec Life’s active credit life insurance book totalled 1.1 million policies at the end of the financial year. From November 2024, Capitec issued more than 600 000 funeral insurance policies on its own licence, and at the end of February 2025, there were 96 307 active life cover policies.

(Capitec exited its funeral insurance arrangement with Sanlam from 1 November 2024, and Capitec Life took over the administration of the policies issued through the cell captive.)

The group launched its first life insurance product in June last year, but the lender intends to expand its market share in life cover.

Said Fourie: “We have 30% market share in funeral insurance, but there are still many opportunities in the life space. Our product offering is still small compared to what insurers like Sanlam, Old Mutual, and Liberty have.”

ALSO READ: Black Friday spending: 23 million clients at one bank spent R25.45 billion

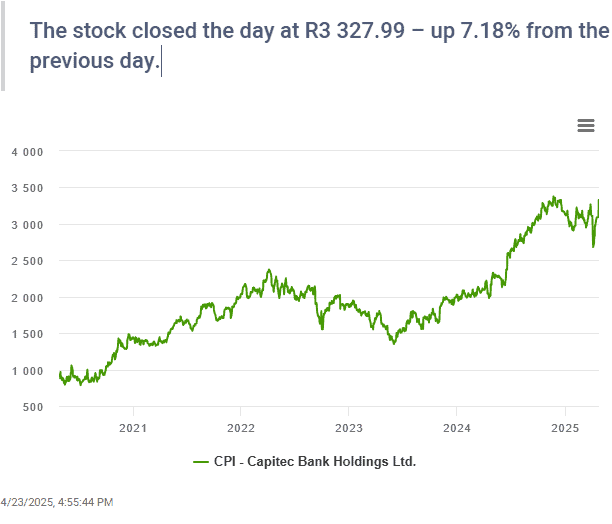

Share price

Capitec’s share price surged over 8% on Wednesday afternoon, following the announcement of the group’s record earnings, which, according to Fourie, are “the best he’s ever seen”.

“It is particularly pleasing that the growth is across all business segments, and not only in one area,” Fourie said.

Denker’s Metherell said Capitec’s stock performance on the day is a combination of good sentiment in the banking sector and the fact that the lender’s results point to strong growth ahead.

He pointed out that the recent sell-off in Capitec shares, along with the “rest of SA Inc”, after the Trump administration’s tariff announcement, means the stock could have performed even better.

*A previous version of this article stated that Capitec now has over 10 million high-earners as clients. This is incorrect and has been amended.

This article was republished from Moneyweb. Read the original here.

Download our app