Should I keep my life savings in my bond?

The question of paying off debt or contributing to retirement savings is something many South Africans wonder about.

Picture: iStock

I have invested my life savings into my home loan over the last two years and am depositing on average an additional R10,000 into my bond over and above my bond repayment. I currently have R840,000 saved in my bond, with a balance of R286,000 until the bond will be paid up. The question I have is as follows: Should I keep making deposits into my bond (my only savings vehicle) until the bond is paid up, or should I rather invest the R840,000 elsewhere to actually grow the amount. The idea is to be bond-free in 18 months (I will be 45 then) and only start saving for my pension at that point. Not sure if this is the correct decision.

The question of paying off debt or contributing to retirement savings is something that must occur to many South Africans. The answer is unfortunately neither simple nor can it be easily applied in a generalised manner as there are too many factors to consider. Each case should be carefully considered with the help of a professional financial advisor.

Your question raises three unique points to consider.

The compounding effect of interest payments

Most South Africans need to take out a loan in order to buy a house. The effect of the compounding interest over time is an important concept to understand.

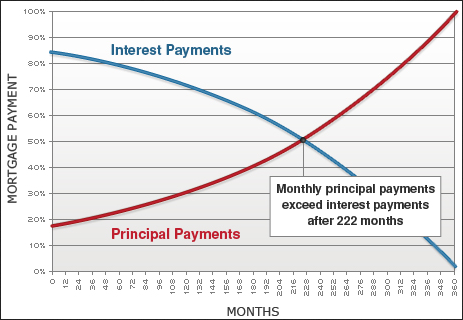

The graph below shows how most of the monthly payments in the early years go towards paying off interest rather than capital/principal debt. Under the scenario below it takes 18.5 years before the majority of the monthly payment starts to go towards the capital repayment and not the interest.

The interest payment in comparison to the capital payment is very important to consider when deciding to pay off debt (good debt or bad debt) versus contributing to retirement savings.

The graph below shows a normal mortgage payment plan by way of the blue line over a 20-year period while the green line shows an additional mortgage payment plan over and above what is required by the creditor. The red line implies the reverse.

Under the additional payment plan, the debtor will be able to reach the point at which more than 50% of their monthly payments go towards the capital and not the interest. Under this scenario, they are able to pay off their bond in 200 months instead of 240 months.

At this point, they have effectively increased their disposable cash flow and reduced the amount of interest they would have otherwise had to pay.

From what I understand by your question, I assume that you may be considering releasing R840 000 of the capital within your bond to possibly contribute to an investment in order to generate capital growth.

I would caution against this as it could be a very risky investment decision. Your intention to be debt-free within 18 months is a good decision. Thereafter you are able to reallocate those monthly payments into a retirement savings plan.

Market uncertainty

Market uncertainty is, unfortunately, a reality over the short term. Depending on your unique circumstances, due to the poor market performance of the past five years, you are no doubt in a better position financially as a result of additional payments towards your mortgage in comparison with a return that you could have otherwise had from investing in the local stock market.

This uncertainty calls for some perspective. Over a 20-year period, an investor may consider paying off their bond while also contributing to a retirement savings plan. Over time their retirement savings plan can effectively compound while they pay off their bond.

This also highlights the importance of appropriate debt levels against the combined household income. Ideally, you want a reasonable monthly mortgage repayment where you are able to effectively repay enough of the capital and the interest at a relatively early stage in the overall repayment period. This speaks to the fact that bad debt (high interest payments relative to capital repayments) could make it unfeasible to contribute to a retirement savings plan when you may in fact need to rather consider reducing your debt levels into something more reasonable. In other words, good market returns are unlikely to keep pace with the interest repayments on bad debt, after tax.

The need to save for retirement

Market returns for a local investor have been poor over the last five years.

Pre-retirement phase: In theory, an investor who is looking to grow their capital over the long term should have the capacity to stay invested until the returns materialise. It is the responsibility of the investor to ensure that they continue to save each month while the investment generates the returns over the long term.

See: The ultimate low-risk, high-return investment

Post-retirement phase: An investor who requires both capital growth and regular income will start to feel the pain of short- to medium-term underperformance, particularly if they haven’t saved enough for retirement. Many retired South Africans have found themselves in this position after the poor returns of the last five years.

The graph below shows the compounding effect of starting to save at different ages.

Once your debt is paid off you can reallocate your monthly bond repayment (the minimum payment plus the R10 000) into a retirement savings plan in order to build up a capital value (critical mass) which can start to effectively compound over time. You must remain diligent when reallocating the bond repayment into a retirement savings plan. It may be tempting to spend a portion of that money elsewhere. As per the above graph, you need to focus on building up the critical mass as soon as possible.

Investors must consider saving for retirement at a relatively young age so that they retire with enough capital which can weather the periods of underperformance over the short to medium term such as the poor market cycle we are currently in.

Brought to you by Moneyweb

For more news your way, download The Citizen’s app for iOS and Android.