Retiring employees are faced with a choice of options. Most involve using all or part of their accumulated savings to purchase an income stream. This is typically done via an annuity. When selecting an annuity, the check-list of items that you need to be taken into account includes your age at retirement, your health, your gender, your income needs and the desire to provide financially for your dependants. For most people, the primary objective is to obtain a sustainable income which keeps pace with inflation.

Until recently the only option available to members retiring from an umbrella fund was to buy an annuity product on your own sold through a life insurance company or a LISP. In the case of living annuities, these products are typically invested in highly-priced unit trusts. Your investment fees alone go up from about 0.80% per annum (a typical fee negotiated by a large retirement fund) to over 1.50% per annum (a typical fee charged by a unit trust) overnight. If you choose a life annuity, most of the time you have no idea what you are paying as fees.

A revolution in the umbrella fund market has led to a number of umbrella funds offering members the option of staying on as a retired member within the umbrella fund, rather than having to fend for yourself independently. However, not all default options are equal, nor are they necessarily cheaper than doing it yourself.

The issues to consider are whether the options offered “within an umbrella ”involve life or living annuities, and on what terms, and whether the investment fees charged continue to be low and institutional in nature, or whether you are being thrown into the world of expensive unit trusts albeit within an umbrella.

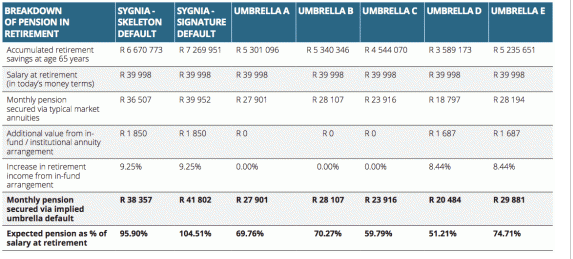

To illustrate the point we have compared the scenario of a member of an umbrella fund who earns R240 000 per annum, contributes 15% of salary towards retirement over 35 years and retires at age 65. The performance assumptions are based on the actual returns earned by each umbrella fund’s default investment strategy over the past 5 years, adjusted evenly to reflect lower expected future returns. We use five of the country’s largest umbrellas in our example. The numbers are expressed in current rand terms.

Sygnia has recently launched an umbrella fund which aims to cut costs by more than a half to ensure that members maximize their savings. Sygnia has also been included using its two different investment default strategies, the Sygnia Skeleton Portfolios (a passive product range) and the Sygnia Signature Portfolios (an active/passive blend). The default retirement strategy is a unique life/living annuity blend which aims to ensure that you can enjoy higher income early on, and then phases in the life annuity aspect to protect you against the risk of longevity.

The accumulated capital within each umbrella has been converted into income via the current default or implied default annuity option offered by the relevant umbrella fund.

The interesting insights from the above are:

i) Some umbrella funds do not have any “paid from the fund” arrangements. Others do, but price them at the same level as individually purchased annuities. Only a few offer members the option of remaining invested in the institutionally-priced investment strategies they enjoyed prior to retiring.

ii) Umbrellas which offer “paid from the fund”pensions are, in the main, able to provide higher incomes because of their lower charging structures. For the person in the example above, this translates to an 8% to 9% increase in their annual income in retirement.

iii) Investment performance remains the key to a wealthy retirement.

iv) The expected post-retirement income as a percentage of your final pre-retirement income can vary vastly. In the example above the range is 51% to 104%, for the same level of contributions into the fund. These are very meaningful numbers.

The calculations above show that the effect of choosing the right umbrella fund which offers the right default strategies, both before and after retirement, could mean the difference between replacing your pre-retirement income in full or receiving only half of your pre-retirement income after retirement, despite making the same contributions over time.

Such a simple decision, yet such a vast difference in outcomes. You really cannot afford to leave your retirement provision to chance. Umbrella funds are changing and the market is evolving. It is important that employers review the umbrella fund options available in the market on a regular basis. It could make a difference between being amongst the haves or the have-nots.