The asset class looks attractive as London sales call.

JOHANNESBURG – Art has not escaped the fall in asset prices globally, but it has historically proven to maintain its value during tough times, the Citadel Art Price Index (CAPI) finds. “The current decline in prices should therefore be seen as a great opportunity to buy art now,” says George Herman, Citadel head of South African portfolios.

“The correlation between global markets and the South African art market is very direct,” says Herman. Herman believes that on a 12- to 18-month view, buying art now in the context of other asset classes and a bigger cyclical view of markets – Citadel believes that the dollar bull market and commodities bear market are coming to an end – makes good investment sense.

Citadel’s Art Price Index collates data on South African artworks sold by seven major auction houses, including Stephan Welz & Co, Strauss, Bonhams and Sothebys. The index excludes gallery and private sale data. Herman estimates that the volume and value captured by these seven auction houses represents a third of the art sales market.

In 2015, the CAPI fell 3% as most mediums experienced negative pricing growth.

“Just as in the first half of 2015, both volumes and total turnover declined by 10%. The average price per piece of R52 900 during this period is marginally lower than the figure achieved for the first half of the year,” Herman notes.

Still, over the second half of 2015, 2 500 pieces were sold across 18 auctions at a total value of R132.3 million. Standout sales included Irma Stern’s Arab in Black, which fetched nearly R18 million on auction in London, while R7.5 million and R4.8 million were paid for two of Alexis Preller’s works.

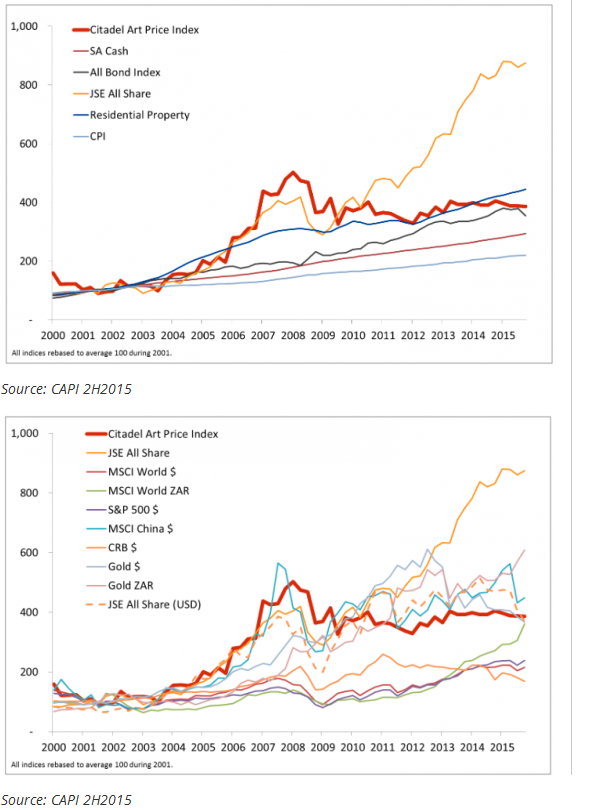

The below graphs reflect the performance of the CAPI Index against major local and global indices respectively.

London calling?

In recent years, South African art has fetched eye-watering prices on auction, particularly in London.

Giles Peppiatt, a director at London auction house, Bonhams believes that South Africa is on the verge of being the key springboard for the larger African market. “This market strength combined with the stability of the sterling and the fall of the rand has established London as the world centre for the sale of African and South African art,” Peppiatt maintains.

In the past nine years, Bonhams has sold in excess of R1 billion worth of South African art.

“Modern African artists that should be followed and will in my opinion continue to appreciate are El Anatsui, Ben Enwonwu and William Kentridge. The one artist who I think will eventually eclipse all these African hands is the South African Gerard Sekoto. I would not be surprised if we sell a work by Sekoto for over a £1 million in the next ten years,” Peppiatt says.

“The demand in London is not as great as it is in South Africa for lesser known artists,” cautions Anton Welz, an auctioneer at local auction house, Stephan Welz & Co cautions.

While the likes of Irma Stern, William Kentridge and Pierneef fetch remarkably high prices overseas, lesser-known artists may be sooner and more profitably sold to local collectors. “I think South African artwork is probably undervalued in international terms because it is not as well known,” says Welz.

The minimum value that Bonhams will accept for sale in London is roughly £5 000, or R 100 000.

It’s also important to be aware that the South African Heritage Resources Agency (SAHRA) may prohibit the export of certain artworks, according to Welz, or insist that a permit is applied for and/or the work be sold on loan.

For instance, the Orientalist Museum in Doha, Qatar was refused a permanent licence to export Stern’s Arab Priest, and was granted a 20-year temporary permit, after which time it will need to be repatriated.

When it comes to the repatriation of funds, Bonhams notes that it is required to send funds to South African bank accounts for the majority of its vendors. “There are exceptions where Reserve Bank approval has been granted to exempt this,” says Peppiatt.

In terms of South African Reserve Bank (Sarb) rules, taxpayers in good standing can invest up to R10 million per calendar year offshore. A tax clearance certificate in respect of foreign investments must be obtained. Alternatively, South Africans can avail of a single discretionary allowance of R1 million per calendar year for investment purposes, with no documentary evidence needed.

Alternative asset class, rand hedge

Herman believes that art as an asset class can undoubtedly be viewed as a rand hedge. “You need only look at what has happened to the prices of Irma Stern over the past couple of years,” he comments.

In general, Citadel considers art to be a very viable alternative asset class over the long-term. “As with any alternative asset class, there are certain provisos around liquidity and transactional costs, which we tell clients to watch out for when we advise them,” he says.

“By the end of March we’ll have a pretty decent idea of where the South African art market is going this year,” Welz notes.

Stephan Welz & Co holds its first auction for the year on March 1, followed by Bonhams on March 16 in London.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.