40% of consumers only have enough savings to last a month.

Results from the 2020 Covid-19 special report of the Old Mutual Savings and Investment Monitor are horrifying.

This is arguably as one would expect in a country where a study last week revealed as many as 3 million jobs were lost between February and April.

Sampling for the monitor was done between 29 May and 23 June and included consumers with an income of at least R5,000 per month.

1. Seven out of 10 households earning less

Sixty-eight percent of households reported worsening household income, with 32% seeing a slight reduction, a further 32% noting a big reduction and 4% where no one in the household is earning an income at all. In the R5,000-R19,999 income band, 74% of households are earning less.

On a personal level, 57% of people have seen their income negatively affected.

This includes 26% who are earning a “bit less” (either through a salary reduction or reduced hours), 23% who have seen a “very significant” impact and 8% who are not earning at all.

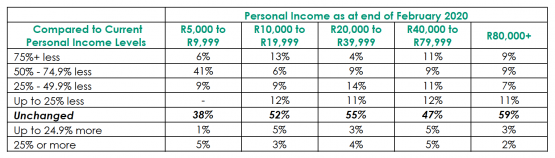

2. “Devastating” knock for 41% of low-income workers

More than four out of 10 workers earning between R5 000 and R9 999 per month have seen their incomes drop by between half and 74.9% from what they were earning in February.

This is not surprising, especially given the entire hospitality sector is in ICU and the retail and manufacturing sectors (aside from essential goods) only reopened in June. Many of these low-income jobs are in these kinds of sectors and some employees have simply not returned to work.

Higher income earners have been noticeably more insulated.

3. Nearly two thirds of those 50+ say their financial situation is worse

Among those older than 50,63% report a worsening financial situation. Part of this, says Old Mutual, “would no doubt be due to increased anxiety as regards loss of value in retirement savings”. A shock such as the Covid-19 pandemic will have magnified the JSE’s underperformance for much of the past decade.

On the whole, 48% of consumers believe that they are worse off financially than last year. Again, this number is higher among low-income earners (54%).

4. Only one in three doing ‘all right’ or ‘comfortable’

The barometer has, since 2014, asked South Africans how they feel they are “getting by”. The results point to an increased struggle over the past six years, with a stark deterioration among those earning R20,000 or more per month.

5. 40% only have enough savings to last a month

The extent to which the lockdown has impacted household savings is clear when one considers the amount of available funds consumers say they have.

Four in 10 have enough money only to last a month or less, up dramatically from 28% in 2019. Again, the deterioration over the past year among those earning more than R20,000 per month is marked.

6. Sharp increase in personal loans

There has been a significant increase in personal loans, with those having taken a loan from a financial institution more than doubling to 43%.

Only 34% of those with loans from a financial institution say they are meeting the repayments comfortably, with a further one in three saying they are “struggling but managing for now”.

A further third are starting to fall behind (22%) or no longer able to make repayments at all (10%).

7. Roughly a third of consumers have requested payment holidays

Approximately four in 10 people have explored or applied for debt relief for personal loans, whether from financial institutions (38%), micro lenders or mashonisas (40%) or friends/family (41%).

This is followed by 35% of those with home loans asking for payment holidays on their mortgages, 29% of credit card holders requesting a break, and 22% of store card customers seeking relief.

In most categories, between 50% and 60% of those who applied have been granted relief. Between 18% and 29% did not, with the remainder saying they are still waiting.

8. More than half of South Africans have dipped into savings to cope

The monitor says 52% have dipped into their savings to make ends meet, more than double the 23% from last year. Most other coping mechanisms have also seen sizeable increases.

The numbers are more pronounced for those earning less than R20 000 per month. For example, nearly half (47%) of those consumers have fallen behind on store (read: clothing) account payments, versus 42% overall.

| 2019 | 2020 | |

| Dipped into savings to make ends meet | 23% | 52% |

| Fallen behind on store card payments* | 32% | 42% |

| Fallen behind on credit card payments* | 15% | 36% |

| Fallen behind on household bills | 24% | 37% |

| Fallen behind on rent or home loan repayments | 7% | 26% |

*excludes those without accounts

9. Consumers are cutting back on (almost) everything

This year, researchers asked South Africans how they expect their spending across categories to change, even when lockdown restrictions end. Rebasing the results to exclude those who don’t currently spend in a category (e.g. non-smokers) reveals startling results on where people will be spending less:

- 68% (less) on eating out/entertainment expenses

- 64% on takeaways

- 60% on holiday and travel

- 49% on hair and beauty

- 48% on clothing and shoes

- 48% on cigarettes

- 47% on home improvement

- 40% on domestic worker/gardener

- 25% on DSTV subscription

- 25% on food and groceries

10. Only one in three is confident about the economy

34% of consumers say they have confidence in the economy, a significant decline from the 44% last year (this figure was 56% in 2015, the first year of the barometer).

This article first appeared on Moneyweb and was republished with permission.

For more news your way, download The Citizen’s app for iOS and Android.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.