The latest cut means that the repo rate has been slashed by 300 basis points or 3% this year, as the bank takes unprecedented monetary policy steps to help mitigate the economic fallout of the Covid-19 pandemic.

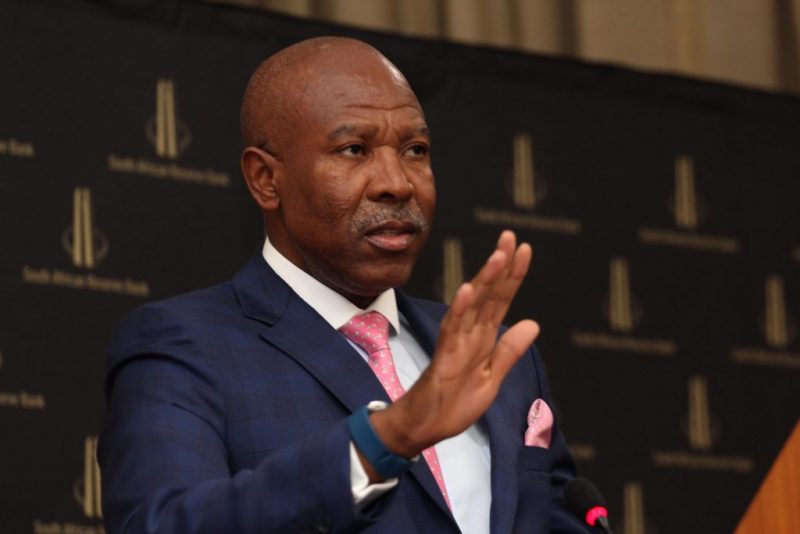

SARB governor Lesetja Kganyago. Picture: Moneyweb

South African Reserve Bank (Sarb) governor, Lesetja Kganyago, announced another 25-basis points repo rate cut on Thursday, taking the rate to a four-decade record low of 3.5% and the prime commercial lending rate to 7%.

The widely expected decision was made following the bank’s 3-day Monetary Policy Committee (MPC) meeting in Pretoria.

The latest cut means that the repo rate has been slashed by 300 basis points or 3% this year, as the bank takes unprecedented monetary policy steps to help mitigate the economic fallout of the Covid-19 pandemic.

ALSO READ: Ramaphosa to address the nation at 8pm on Thursday

In April, amid the initial Covid-19 “hard lockdown” to curb the pandemic, Sarb called an emergency MPC meeting and slashed the repo rate by 100 basis points. At its last meeting in May, it cut the rate by a further 50 basis points.

“The Covid-19 outbreak has major health, social and economic impacts, presenting challenges in forecasting domestic and global economic activity. The compilation of accurate economic statistics will also remain severely challenged,” Kganyago said in his MPC address.

“Our second quarter estimate for output has been revised lower. The Bank currently expects GDP in 2020 to contract by 7.3%, compared to the 7.0% contraction forecast in May,” he said.

“Even as the lockdown is relaxed in coming months, for the year as a whole, investment, exports and imports are expected to decline sharply. Job losses are also expected to rise further,” added Kganyago.

This article first appeared on Moneyweb and has been republished with permission.

For more news your way, download The Citizen’s app for iOS and Android.

Download our app