Losing just a few thousand wealthy people could have a huge impact on government revenues. And they are at great risk of leaving.

Given the unsteady state of South Africa’s public finances, meeting tax collection targets is vital. The country has to keep its budget deficit at a reasonable level by ensuring that it brings in enough revenue.

However, figures from the South African Revenue Service (Sars) to the end of August have shown that tax collections have been below where they should be. By this point last year, Sars had collected 39% of its target. For the 2019/20 year, it had only reached 37%.

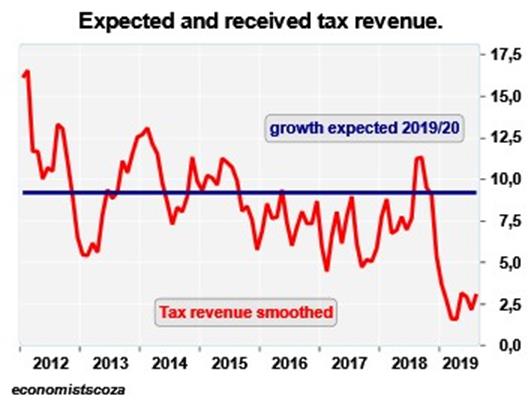

As the graph below from Economists.co.za’s Mike Schüssler illustrates, there has been a notable decline in revenue collection relative to previous years. As Schüssler notes, this is despite a higher VAT rate, and personal income tax brackets not being adjusted for inflation, which sees people paying tax at higher rates.

This has also resulted in a severe drop in taxes collected relative to National Treasury’s own expectations:

Counting on individuals

Personal income tax collections are of particular concern because South Africa relies heavily on these revenues. Of the R1.422 trillion that the government has budgeted to take in during the current tax year, R553 billion, or just under 40%, is expected from this source. The country’s 7.5 million registered taxpayers carry an extremely important burden.

Even more specifically, those who earn more than R1.5 million per year are budgeted to contribute R160 billion in tax this year. That is 11.2% of the total expected revenue.

This is reflected in the table below from the 2019 budget review:

While this illustrates South Africa’s progressive tax system, which requires higher earners to pay proportionally more, it also highlights a vulnerability. More than a 10th of the country’s entire revenue is budgeted to come from just 120,751 individuals – 0.2% of the population.

It has been noted before how placing more and more demands on this small group could increase the risk that they move either themselves or their assets elsewhere. This is, after all, a highly mobile demographic. If they feel their taxes are not being properly spent and the opportunities for them in other countries with lower tax rates are more attractive, they have the option of leaving.

“If just 10% of those people [12,000 individuals] were to decide to leave, you would lose R16 billion of taxes,” says Bernard Sacks, tax partner at Mazars. “That is somewhere we are very vulnerable.”

To put this into perspective: R16 billion is significantly more than the revenue National Treasury projected to take in this year from the 2.4 million taxpayers earning less than R150,000 per year.

Signs of trouble

Worryingly, an analysis of the tax collection figures to August suggests that revenues from this group may indeed be slipping.

Many of the highest income earners in South Africa would be registered as provisional taxpayers. In other words, they earn income other than just from a single salary, and are required to submit returns twice a year.

Comparing the revenue received from provisional taxpayers in the 2018/19 tax year to how much has been recovered from them so far this year reveals a concerning picture. Despite National Treasury’s expectation that both the number of high-income earners and the amount of tax they pay would go up, the figure taken in from provisional tax has actually fallen.

| Provisional tax, assessment payments and penalties collected to August | ||||||

| 2019/20 | 2018/19 | |||||

| Budget estimate | YTD | % | Preliminary outcome | YTD | % | Change |

| R53 713 812 | R14 592 059 | 27% | R49 432 083 | R17 796 236 | 36% | -9% |

Source: Sars

While, on aggregate, provisional taxpayers will always pay more in the second half of the tax year, the drop in collections both in nominal terms and relative to the total amount expected is noteworthy. It suggests that there may be a gap developing in this segment of the tax base.

This also aligns with figures showing that more wealthy South Africans are looking to emigrate.

LIO Global recently noted that applications from South Africa for the USA’s EB-5 Investor Green Card Programme, which opens up US citizenship for those able to invest at least R7.6 million into the country, have more than tripled.

As Sacks notes, this has potentially serious implications for the country. Not just because of the impact on revenue collection, but for the economy more broadly.

“Those mobile people would also be big spenders in the economy,” he points out. “So when they leave, your VAT goes down as well. They could potentially be moving their businesses abroad, so your company tax could go down. Your employment could go down.

“You are not just losing a bit of personal income tax – there is a ripple effect right through the economy.”

Brought to you by Moneyweb